AI Accounting Firm for Startups & MSMEs

Bookkeeping to reporting with AI in minutes reviewed by experts

The Chop Finance Way

Fast. Connected. Clear

Real time books that stay accurate on their own

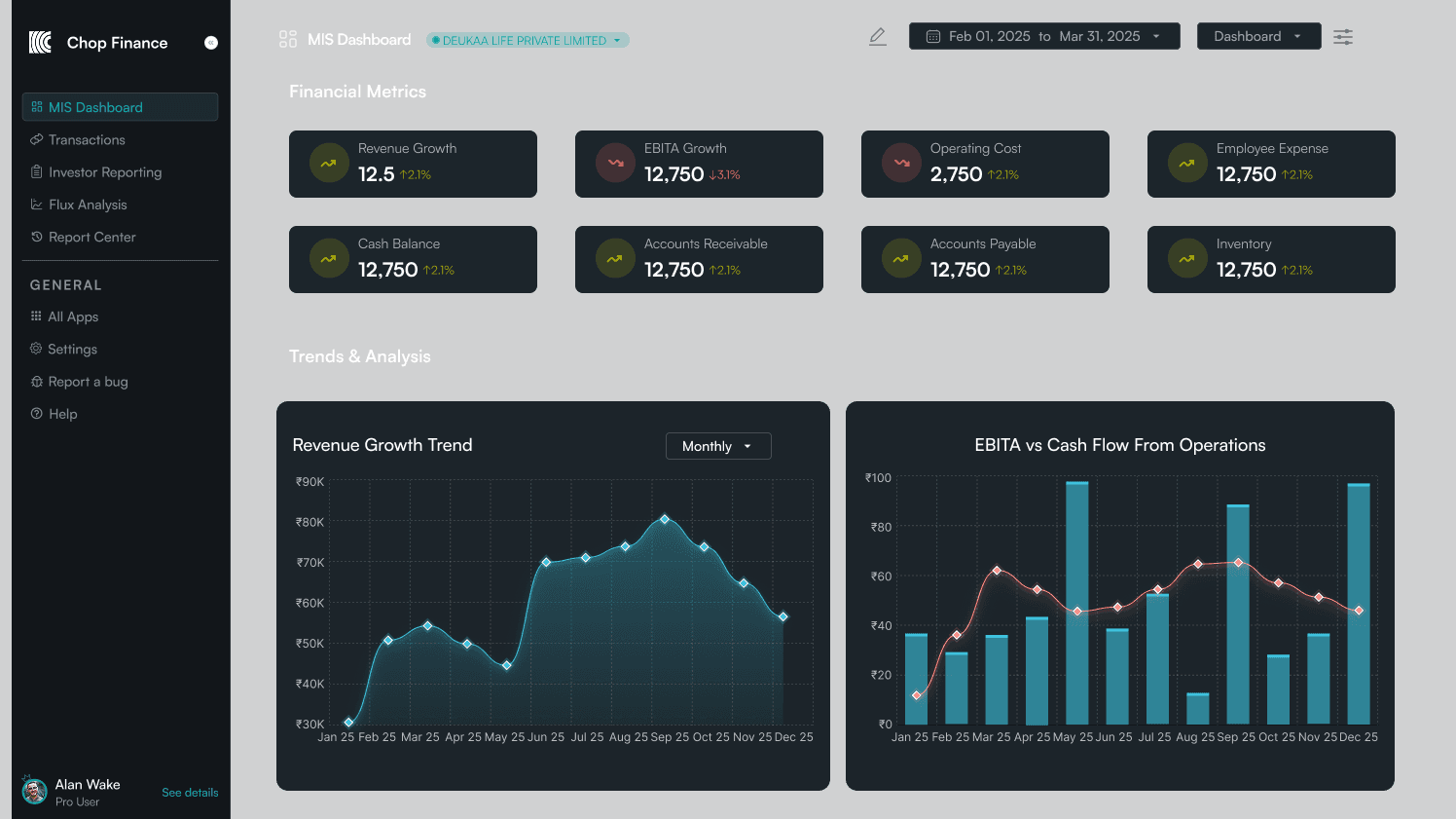

Faster reconciliations and automated MIS reporting

Make decisions with accurate, up-to-date numbers

The Old Way

Slow, manual, and dependent on follow-ups

Numbers scattered across spreadsheets and tools

20+ days to close books, delaying critical decisions

Limited visibility until the month is already over

100% Accuracy

Books with 100% accuracy, available 24/7

Expert Team

A dedicated bookkeeping team, 7 days a week

Faster Close

Automation driven workflows that significantly reduce close timelines.

Timely Reporting

Clear MIS and KPI dashboards delivered on schedule with variance explanations.

Advanced Reconciliations

Generate complex, transaction-level reconciliation reports in minutes.

Investor Readiness

Due diligence ready books and fundraising support

A Note from the Founder

Nayan Goswami

Co-founder & CEO of Chop Finance

Security & Data Assurance

Controlled Data Sync

Financial data is synchronized securely across connected systems without manual exports or duplicate entries

Secure & Scalable

Encrypted data handling, controlled access permissions, & scalable infrastructure

Actionable Insights

Structured analytics highlight trends, variances, and performance signals to support faster financial decisions.

Real-Time Financial Monitoring

Real-Time Collaboration

Encrypted Data Storage